My weekly read-around...

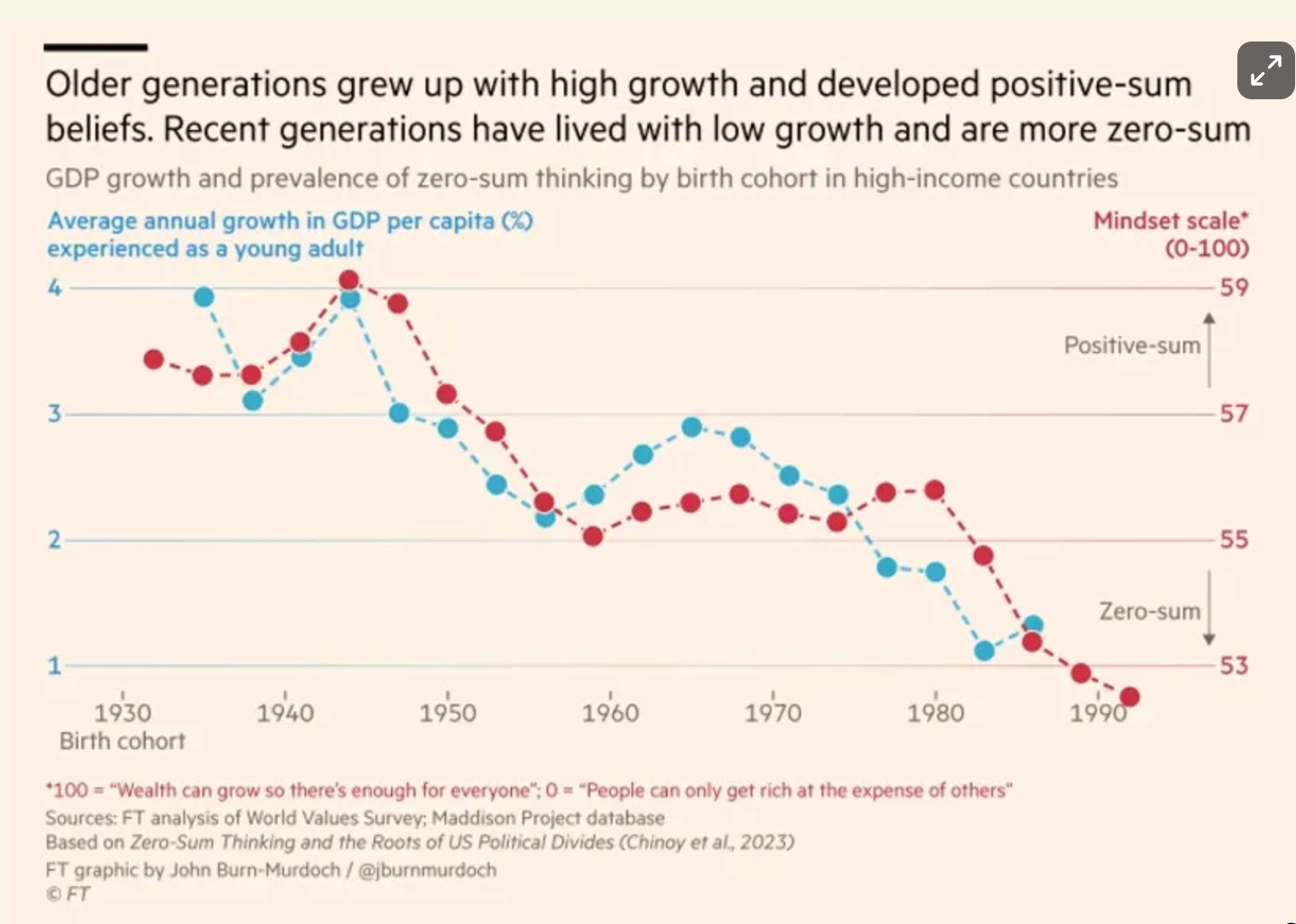

ONE IMAGE: Growing Zero-Sum Thinking:

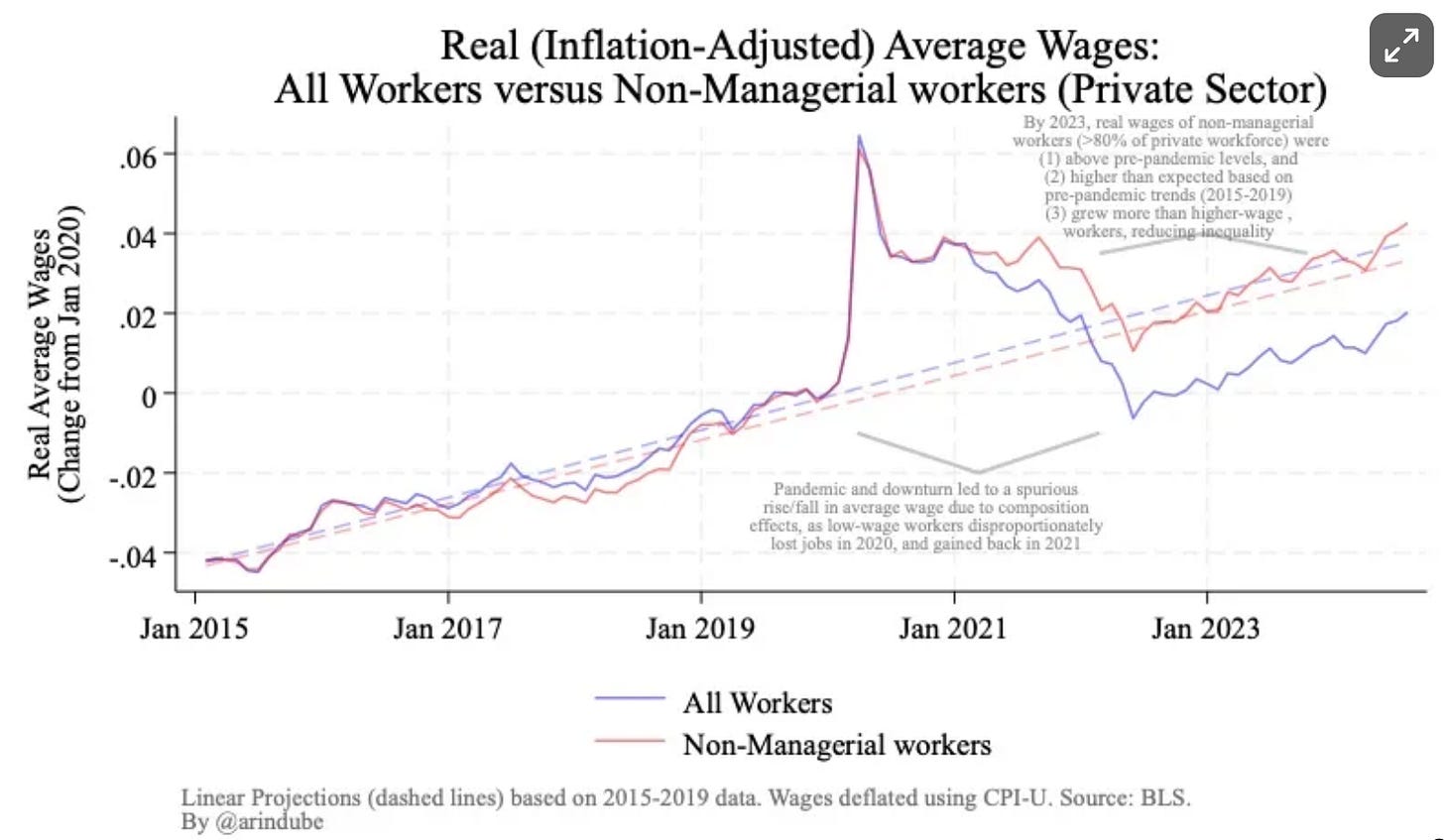

ANOTHER IMAGE: The Reset of the Non-Managerial Pay Discount:

ONE VIDEO: Sean Carroll on Fine-Tuning:

ANOTHER VIDEO: We Need to Talk About BREXIT:

Very Briefly Noted:

Economics: Larry Summers believes that I should not have ended my Slouching Towards Utopia <http://bit.ly/3pP3Krk> with: "a new story begins…” He believes I should've ended it with: "the story continues…” “The story” here is that techno-economic progress powered by the institutions evolved in the Dover Circle doubles humanity’s technological prowess every generation via Schumpeterian creative-destruction, with some large group of people every generation in the "destruction" bull's-eye. We have to rewrite humanity’s organizational software code that runs on top of the techno economic mode of production hardware so that the system does not crash more often than it does. We have to do this on the fly. But we are tremendously aided by the enormous technological dividend we have to distribute to grease transformation. But what if people do not believe this technological dividend is actually there? What John Burn-Murdoch observes here is a vibe shift that is one of the major reasons I think that I am right, and Larry is wrong here:

John Burn-Murdoch: Are we destined for a zero-sum future?: ‘A backdrop of slower economic growth may be shaping attitudes of tomorrow that cut across political divides…. A zero-sum mindset is not in itself clearly a good or bad thing, morally speaking. The same belief system that might drive one person to take care of the disadvantaged might lead another to pull up the drawbridge. But economically speaking, there is a growing body of evidence that such a worldview is associated with demotivating beliefs — the sense that extra effort is not rewarded — and in turn with lower rates of innovation at the societal level. <https://www.ft.com/content/980cbbe2-0f5d-4330-872d-c7a9d6a97bf6>Economics: And where, at least in the United States, zero-sum thinking—and the belief that change is at least as likely to take from you what you have as to open opportunities—comes from:

Sahil Chinoy, Nathan Nunn, Sandra Sequeira, & Stefanie Stantcheva: Zero-Sum Thinking and the Roots of U.S. Political Divides: ‘Zero-sum thinking – the belief that gains for one individual or group tend to come at the cost of others.,,, 20,400 U.S. residents, we measure zero-sum thinking, political preferences, policy views, and a rich array of ancestral information spanning four generations…. More zero-sum mindset is strongly associated with more support for government redistribution, race- and gender-based affirmative action, and more restrictive immigration policies. Zero-sum thinking can be traced back to… the degree of intergenerational upward mobility they experienced, whether they immigrated… or lived in a location with more immigrants, and whether they were enslaved or lived in a location with more enslavement… <https://scholar.harvard.edu/files/stantcheva/files/zero_sum_political_divides.pdf>

Economics: Here is a prominent example of current I above:

Goldman Sachs Research: US Economy Is Poised to Beat Expectations in 2025: ‘Goldman Sachs Research predicts US GDP will grow 2.5% on a full-year basis. That compares with 1.9% for the consensus forecast of economists surveyed by Bloomberg…. While the expected policy changes under President elect Donald Trump may be significant, Mericle doesn’t project that they will substantially alter the trajectory of the economy or monetary policy. “Their impact might appear most quickly in the inflation numbers,” Mericle writes. Wage pressures are cooling and inflation expectations are back to normal. The remaining hot inflation appears to be lagging “catch up” inflation, such as official housing prices catching up to the levels reflected by market rents for new tenants… <https://www.goldmansachs.com/insights/articles/the-us-economy-is-poised-to-beat-expectations-in-2025>Economic History: The problem with this—correct—argument about what the Primary Branch of the US government decided back in the 1930s, and what has worked since, is that at least five members of the corrupt Supreme Court do not care, and believe that a Republican president should be the Primary Branch:

Gary Richardson & David Wilcox: Federal Reserve Independence and Congressional Intent: A Reappraisal of Marriner Eccles’ Role in the Reformulation of the Fed in 1935": ‘Understanding what Congress intended when it designed the decision-making structure of the Fed requires a clear understanding of Marriner Eccles’ proposal for the structure of monetary policymaking in Title II of the Banking Act of 1935 and the Congressional response. Eccles' proposal vested monetary policymaking in a body beholden to the President…. The Senate and House rejected Eccles' proposal and explicitly designed the Fed's leadership structure to limit politicians'—particularly the President's—influence on monetary policymaking… <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5024269>In the Chaos-Monkey Cage: there is a big gap right now in assessments of the forthcoming Trump Administration II. Some think that Trump wants to be the center of attention and make a splash – definitely does not want to do anything that makes the stock market go down – and to the extent that he does do chaos monkey things they said it will block him. Others take what he says seriously, and expect a substantial chance of catastrophe. The interesting paradox is that only if the second current is extra-strong can the chances of at least one of the many catastrophes that now threaten us be diminished:

Maury Obstfeld: Trump’s Inflationary Triple Threat: ‘With unified Republican control of the White House and Congress, US President-elect Donald Trump is poised to pursue radical economic policies. By undermining the independence of the Federal Reserve, enacting massive tax cuts, and loosening cryptocurrency regulations, he risks triggering an inflationary surge…. The success of central banks over the past four decades stems directly from the independence that domestic critics of US monetary policy seek to strip from the Fed…. The Committee for a Responsible Federal Budget estimates that Trump’s proposals would increase the federal deficit by nearly $7.8 trillion between 2026 and 2035, even after factoring in projections of increased tariff revenues…. The antidote to fiscal recklessness is not to undermine the Fed. It is for the political branches of government to recognize the unsustainable trajectory of US fiscal policy, avoid exacerbating it, and pursue sensible tax and spending reforms…. [The] third component of Trump’s inflationary triple threat is unprecedented…. Integrating cryptocurrencies into the US financial system without stringent regulatory oversight is a surefire recipe for crises, recessions, massive government bailouts, and even larger public debts… <https://www.project-syndicate.org/onpoint/trump-economic-agenda-three-severe-inflation-risks-by-maurice-obstfeld-2024-11=>Neofascism: I am being driven more and more to the idea that a functional “populist” politician promises and implements seisakhtheia—cancels the debts and redistributes the land in order to make the polis a genuinely better place, and in the process accumulates and maintains enough political support to draw the fangs from the combination of oligarchic wealth and clan-head patron-client networks that usually runs things. But Trump’s personalized version—because I look like your friend on the video, you will get some of the goodies from this—does not fit at all into that schema:

John Ganz: The Shadow of the Mob: ‘Gangster Gemeinschaft…. As my friend Eric Levitz quipped on Twitter, Resistance Libs like to say, “Trump is a sociopathic gangster.” Pro-Trump swing voters respond, “Yes, exactly!” Trump talks and acts like a mafioso. He’s not trying to hide it…. “This is how things work.” Everything’s a racket: You’re either on the outside, a chump, or on the inside, making it…. What Trump offers is the clubbiness of the mob for the masses. He offers a big hug and a kiss. He brings you into his “family”… He’s “the guy who does bad things but does them on behalf of the people he represents.” He might kick the shit out of the other guy, but to you, the guy on his side, he’s warm, gregarious, and fun: he winks and slaps you on the back. For these voters, the “system” has failed, so we need Trump… <https://www.unpopularfront.news/p/the-shadow-of-the-mob>MAMLMs: In my view—with the exception of Apple, that seems to have a strategy—the verdict on these attempts to gain “AI Independenc” is: too-little, too-late. And Apple too may be in the same position. I view the slow rollout of the software of Apple Intelligence as reflecting their knowing they also have a hardware gap—that Apple needs the Jade4C M4, M5, and M6 Ultra chips that it does not yet have (and may never have) to make a go of their “we will build and run our own privacy-secure data centers” MAMLM strategy;

M.G. Siegler: The Race for AI Independence: ‘Today's: Amazon steps up effort to build AI chips that can rival NVIDIA…. A few days ago[:]… Amazon/// dangling billions… [if] Anthropic… would commit to using these new chips…. Google was early in building out their own chips. Microsoft… working on their own chips…. OpenAI… also…. Apple is already using their own chips and building more…. Meta seems perhaps most wedded to NVIDIA given the love-fest between Mark Zuckerberg and Jensen Huang on various stages around the world. But of course, they're also working on their own AI chips…. [Right now] everyone (aside from perhaps Apple) is buying as many NVIDIA chips as they can get their hands on…. And the spend. Oh, the spend. Amazon recently said it's going to spend $75B on capex this year, with much of it going towards the AI build up and out. The rest of Big Tech is in similar boats…. Wall Street is not going to like that too much. Probably sometime soon. And so, Operation: Independence is on. But these chips are just one element of independence…. Microsoft… decoupling from OpenAI…. OpenAI… trying to break their own dependence on Azure (and NVIDIA chips)…. Apple… to think they're going to rely on third-parties for AI indefinitely is to think that AI is not going to be a big deal…. This cycle… everyone is quickly joining Apple…. The costs… ramping so fast with NVIDIA cornering the market so fast… Big Tech quickly realized they needed… to try to gain "AI independence"… <https://spyglass.org/the-race-for-ai-independence/>MAMLMs: An LLM that is only as smart as your typical internet s***poster is not an asset to humanity considered as an anthology intelligence. And, no, putting a RAG layer on top will not fix the problem:

Phin Barnes: The Real Value of AI Isn’t General Intelligence: ‘The market for artificial general intelligence is small. Founders should bet on specialized solutions instead…. The entire internet’s text content is estimated at about 100 petabytes, of which GPT-4 is already trained on a significant fraction. Where do we go from here?,,, [Not by] creating an echo chamber of artificial knowledge, and new models may resemble old ones.… The real opportunity lies in…. Low-hanging fruit… data that exists but needs muscle to extract…. Hidden treasures… offline and semi-private information… transaction data, targeting insights, and private social platforms… messy, fragmented, and extremely valuable. The experiential holy grail… that captures what it means to be human: the ambient conversation in a busy coffee shop… subtle dynamics of an office meeting. Whoever captures human interactions in ways that create genuine understanding will be able to build AI that understands humanity... <https://every.to/thesis/the-real-value-of-ai-isn-t-general-intelligence>

SubStack NOTES:

SubStack Posts:

If reading this gets you Value Above Replacement, then become a free subscriber to this newsletter. And forward it! And if your VAR from this newsletter is in the three digits or more each year, please become a paid subscriber! I am trying to make you readers—and myself—smarter. Please tell me if I succeed, or how I fail…

@Brad DeLong

What are your thoughts on Turchin's grand view of revolutions in history? Given your own "guesses" on average GDP and wages going back even beyond teh ancient world, how does Turchin manage to determine the widining and narrowing of inequlaity in Ancient Greece and Rome? What abot state finances? Does he use some tested proxies to determine these trends? I can see this is possible once we reach the last 500 years of so, but 2500 years ago...?

MAMLMs:

"Whoever captures human interactions in ways that create genuine understanding will be able to build AI that understands humanity... "

I don't believe that is true. At best it is a simulation that gets closer to crossing the "uncanny valley". The problem here is that "create genuine understanding" is lifting a lot of weight that is unsubstantiated, especially for an AI that is not embedded in the world.

Narrowing the scope of training I agree with, but this is just assuming a somewhat orthogonal data set will solve the problem...of what...appropriate human interactions?